Cashback reward program

When payment is made with credit card, sellers pay small percentage of the transaction to their bank or merchant. Many credit card companies, especially those in the United Kingdom and United States, share the commission with the owner of card by giving him money bonus, points that can be exchanged for prizes and discounts once some level of purchases is reached.[1] A monetary benefit is known as cashback, sometimes pronounced as two separate words in the United States - (cash back).[2] Usual cashback amount is between 0.5% and 2% of buyers net spending (purchases minus refunds and tax) as a yearly bonus, which is either added to the credit card account or paid by cheque, cash or wire to the participant.[3]

Recently, major card issuers have increased cashback amount to 5% for purchases especially in grocery stores and petrol stations.

In most cases bonuses like cashback are offered to customers that pay off their credit debt on time every month.[4]

Cashback Reward Program Media

Credit cards from the South African Absa Bank

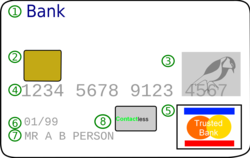

An example of the front in a typical credit card:*Template:Ordered list*

An example of the reverse side of a typical credit card:*Template:Ordered list*

Visa, MasterCard, and American Express are card-issuing entities that set transaction terms for merchants, card-issuing banks, and acquiring banks.

An example of street markets accepting credit cards. Most simply display the acceptance marks (stylized logos, shown in the upper-left corner of the sign) of all the cards they accept.

Acceptance mark at an automated teller machine

References

- ↑ Kagan, Julia. "Cash Back". Investopedia.

- ↑ "So why use Greasypalm". Archived from the original on 2017-11-04. Retrieved 2021-01-17.

- ↑ "What is Cashback in simple words?" (in русский). Retrieved June 6, 2021.

- ↑ "BBC World Service - Learning English - Keep your English up to date". www.bbc.co.uk.